🤔Concentrated Liquidity

Web app is available at shadow.so

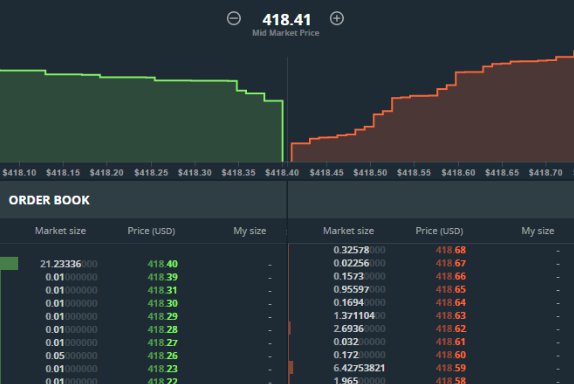

Concentrated Liquidity is currently the most efficient and profitable method of market making that on-chain decentralized exchanges have access to. This type of liquidity was initially popularized by Uniswap with their UniV3 model. To get an idea of what Concentrated Liquidity offers we can compare it to a more centralized, and well-known, liquidity scheme: A CEX Order Book.

As you can easily see in the CEX Order Book diagram above, the bid (buys) and asks(sells) are clearly shown, and the depth at which a market order would impact the median price is visually discernible. Interesting enough, the concentrated liquidity model, is represented visually as an inverse histogram of the order book (imagine flipping the photo below upside down and inverting the colors and you will see the traditional CEX order book appears).

The red shaded area represents the liquidity ranges summed between all users within the liquidity pool (within the same fee-tier, more on this later).

The efficiency differential between a traditional UniV2 (x*y=k) and UniV3 concentrated liquidity orderbook-style AMM can be explained by reference to the fact that in a UniV2 liquidity pair, liquidity positions operate on a range of 0 to infinity (0,∞).

This means that each individual liquidity provider in the pool is subject to providing liquidity in every possible positive real-number. Since every trade has to consider this when the swapping algorithms are executed, $100,000 of liquidity spread from 0 to ∞ is exponentially less efficient than, say, one with a defined range of ($1,000-$1,100). With the latter example of the $1,000-$1,100 liquidity range, it is calculatable that the same $100,000 of liquidity is now concentrated in a $100 price range, providing a massive improvement in efficiency and liquidity depth within the specified range. Concentrated liquidity pairs have the ability to provide the lowest slippage currently available in decentralized exchanges.

Last updated